The merger and acquisition (M&A) market is continuing on an upward trend after hitting a record low in Q2 2020. Has your institution been contemplating an M&A? Or, perhaps you’re going through the process now. M&As offer the potential for expanded reach, more efficient scalability, and combining resources to fill gaps in product or service offerings.

The rewards are plentiful, but so too is the risk. According to the Harvard Business Review, between 70 and 90 percent of M&As fail. The reasons why nearly always boil down to missteps in regards to:

- Brand Strategy

- Audience (Re)focus

Let’s take a deeper dive into each to ensure your merger or acquisition overcomes the odds.

Brand Strategy

An intentional and well-designed brand strategy is mission-critical to the success of every M&A; a brand is the face and personality of your institution, thereby influencing customer and stakeholder perceptions, attitudes, and satisfaction.

Selecting the right brand strategy is crucial, yet this is where so many M&As immediately go astray. A few of the more common M&A brand strategies include:

- Business-as-Usual. Each brand retains their original identities. (Ex: AOL and Huffington Post).

- Assimilation. The acquiring company absorbs the acquired company’s brand (Ex: Sprint is now T-Mobile). This strategy is typically used when there is a clear “stronger horse” brand, as was the case with T-Mobile and Sprint.

- Fusion. Organizations that use branding elements from both companies, either by combining the two names (as in Pricewaterhouse Coopers) or by taking the name of one company and the logo of the other (Boeing kept its name, but adopted McDonnell Douglas’s logo).

- New Brand. The most aggressive option following an M&A is to develop an entirely new brand. This approach is used to signal complete transformation. (Ex: GTE and Bell Atlantic, two phone line companies, merged to create Verizon.)

Conducting brand research and analysis to determine each player’s strengths (or lack thereof) in the marketplace will help guide the decision for which approach is best suited for your merger or acquisition situation. Revel’s research team garners such insights through our own proprietary process of qualitative and quantitative study, including consumer interviews and surveys, combined with in-depth mining of secondary source data.

Identifying brand value through that process should also naturally come into clearer focus. What is a higher purpose from this merger or acquisition that people can rally around? Defining that higher purpose, and its story, will prove to be make or break for motivating existing customers, employees, and stakeholders to stand by you through this major transition.

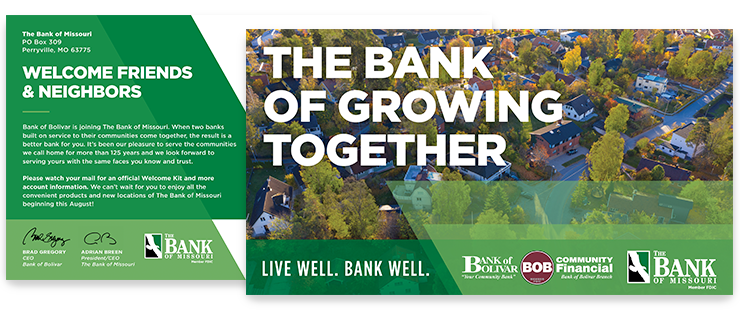

Take for example the acquisition of Bank of Bolivar by The Bank of Missouri. The Revel team was engaged by The Bank of Missouri to support their brand strategy with the development of a transitional ad campaign and strategic marketing plan. Through our own internal research, it was determined that the higher purpose of this acquisition would be beneficial growth that feels familiar. Customers would enjoy more convenient locations and expanded product and service offerings, but through the same friendly faces they had come to know and trust. The “Growing Together” campaign was rooted in expressing this identified higher purpose.

Once a branding strategy and higher purpose are determined, the next step is fleshing out marketing messaging and communications for both external customers and internal employees. Here is where a deep understanding of your audience is essential.

Audience (Re)focus

“People first” is a key tenant of every sound business strategy, but especially so during M&A transition periods. How you communicate M&A changes to customers, stakeholders, and employees will influence either continued support or abandoning ship.

A recent worldwide survey by PwC found that the majority of consumers don’t believe companies consider their customers strongly enough during the M&A process. Whether this is actually true or not isn’t the point; perception is reality. That’s why it’s important to craft a campaign that clearly lets customers know they are still your top priority.

Our “Growing Together” campaign for The Bank of Missouri worked to do just that. We understood that Bank of Bolivar’s friendly, tenured employees were a primary reason why their customers were so loyal. The team at Revel leveraged this insight for the creative development of a video, billboards, radio spot, direct mailers, and more.

A key messaging point across all campaign materials for The Bank of Missouri was, “The same faces you know and trust.” Original photography featuring the Bank of Bolivar’s smiling staff was featured as well to visually reinforce this key messaging point. Understanding also that Bank of Bolivar’s customers appreciated the “small town hospitality” presented by that bank’s brand, we ensured the new campaign underscored the importance of local relationships, fostered feelings of ease and comfort, and avoided any associations that might imply “Big Bank” hostile takeover.

Internal employees are also part of your M&A audience, yet too often they get lost in the transitional chaos. Failure to properly communicate and gain positive buy-in from employees can have dire consequences, as was demonstrated with the Sprint Nextel merger in 2004. Sprint was rigid and highly bureaucratic, while Nextel was known for a more entrepreneurial, “free spirit” attitude. The merging of these two cultures was not the yin and yang executives had hoped for, reportedly due to strong resistance and lack of proper cultural integration. The merger was ultimately a disaster for both parties and to this day is remembered as one of the worst in history.

Avoid the same fate by focusing on cultural integration early-on in the M&A transition. Foster an environment that embraces differences, and that works to find common ground (here’s where your higher purpose comes into play). Encourage buy-in by creating excitement around the benefits and opportunities that are made possible by the M&A. This can be done in a variety of creative ways, such as hosting fun employee events or distributing branded swag bags.

Navigating a merger or acquisition is complex. The stakes are high. Don’t go at it alone. The Revel team is expertly equipped to guide your brand to success. Call or email us today to discover how Revel can strategically support you through the M&A process.

Sources:

Morrison Foerster. M&A in 2020 and Trends for 2021. January 2021.

Harvard Business Review. Why Fusing Company Identities Can Add Value. September 2011.

PwC. CX in M&A: What Consumers Think When Companies Combine. April 2017.